AUSTRALIAN MEAT EXPORTS IN JULY (2021-2022)

30 de August de 2022

Argentina – Pork meat evolution

30 de August de 2022For this blog we are going to focus from 2017 to July of this of this year 2022.

Within the "poultry" category, the most demanded product is chicken. Although also to a lesser extent turkey and duck.

The United States, together with Brazil, are the two main suppliers of chicken products to China.

According to the USDA report, the most demanded product would continue to be chicken feet. China's imports of this product grew rapidly last year and strong demand is expected to continue in 2022.

This product began to be demanded more strongly in 2020 with the onset of the pandemic.

For this year, it was estimated that China would produce 3% less chicken and, as a consequence, would have to import more chicken.

So far in 2022, we can say that these predictions are coming true.

Since January, 162,894,070 kg worth USD 692,780,627 of chicken feet have been exported to China.

In terms of chicken in general, 245,564,169 kg have already been exported. The year 2021 ended with twice as many kg exported and this year is expected to close with even more kg.

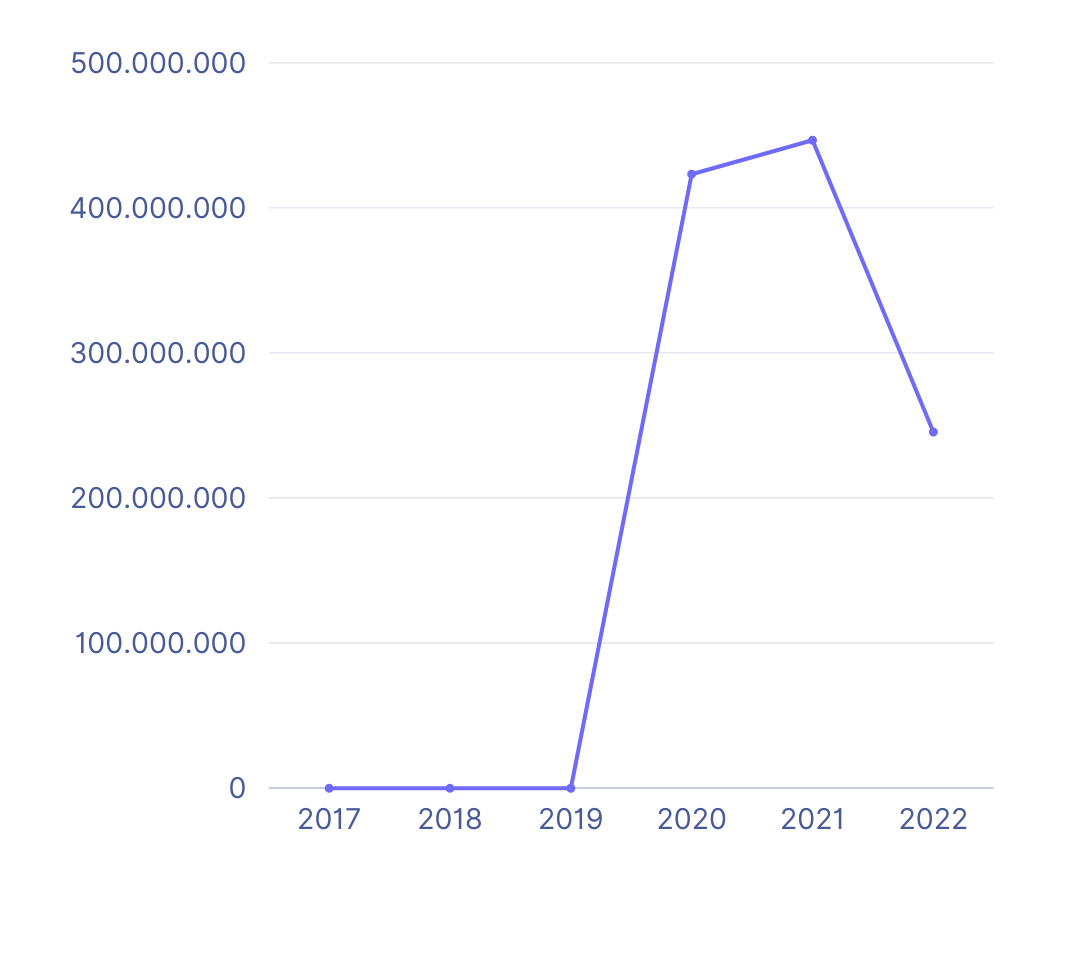

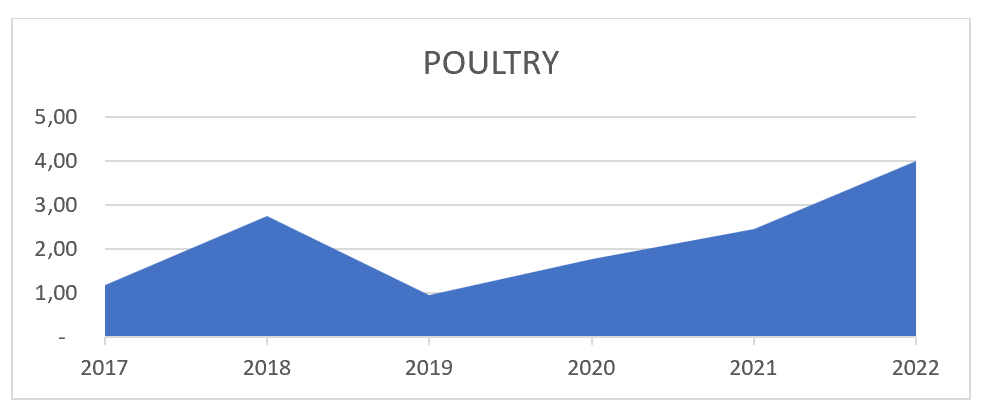

According to the data since 2017, the "bird" category has undergone a very considerable increase to the figures we know today. To be more exact I show you with the following graph.

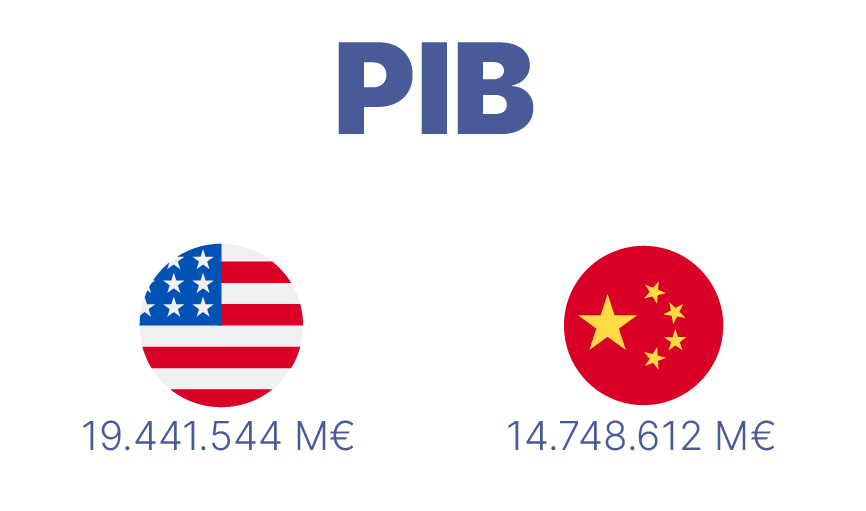

We note that 2017 poultry exports were very low. A total of 3,555 kg were exported. The explanation for this could be found in the fact that domestic production was higher due to lower purchasing power in China. But with the development of technology, innovation and services within the country, the GDP has come close to U.S. levels. As a result, the volume of imports becomes much higher also due to the demand for products.

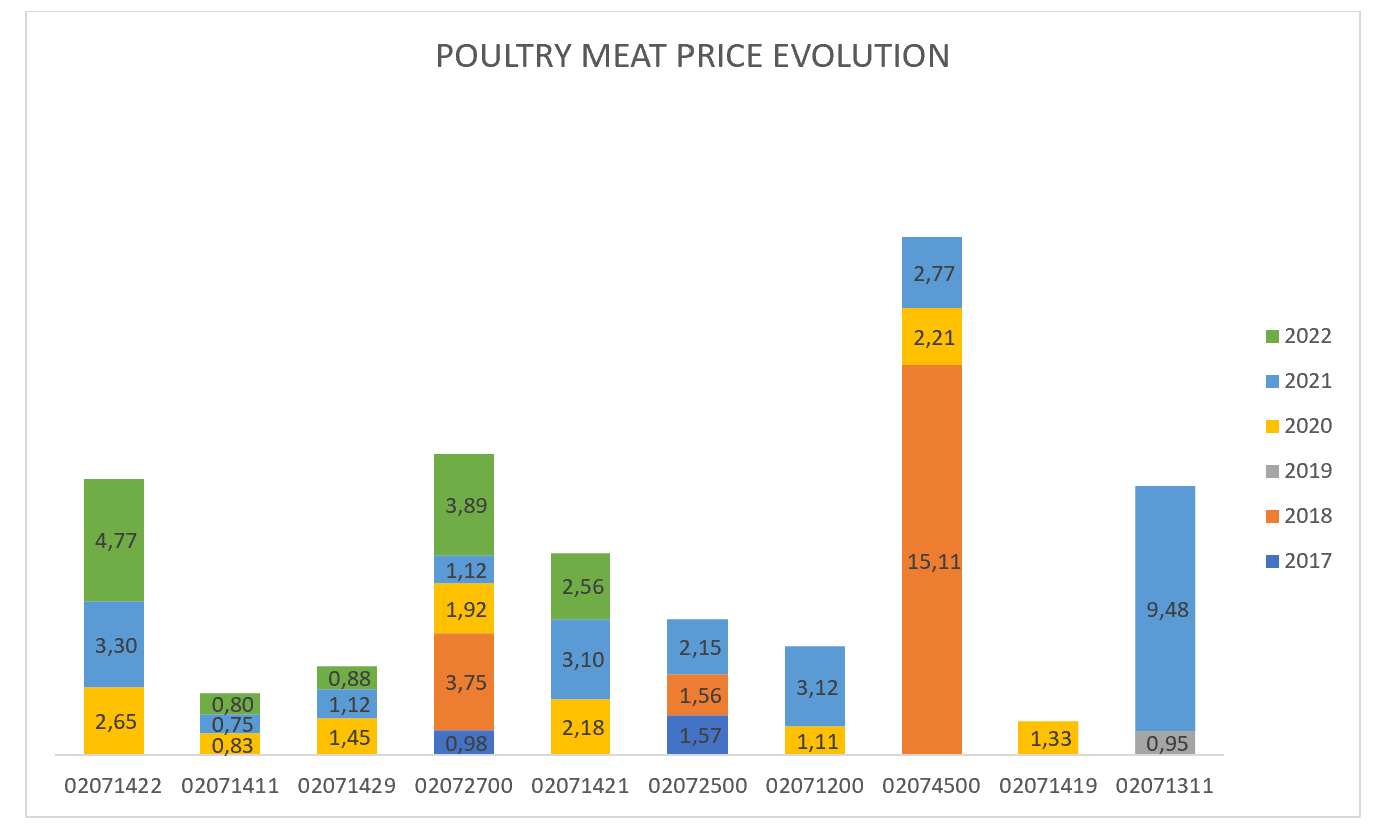

In terms of prices, we also denoted a considerable evolution within the poultry category between 2017 and up to July this year.

At present, July 2022, most of the prices of specific poultry products have increased. The price of the category has increased by 64% since last year.

Why is the price going up? .

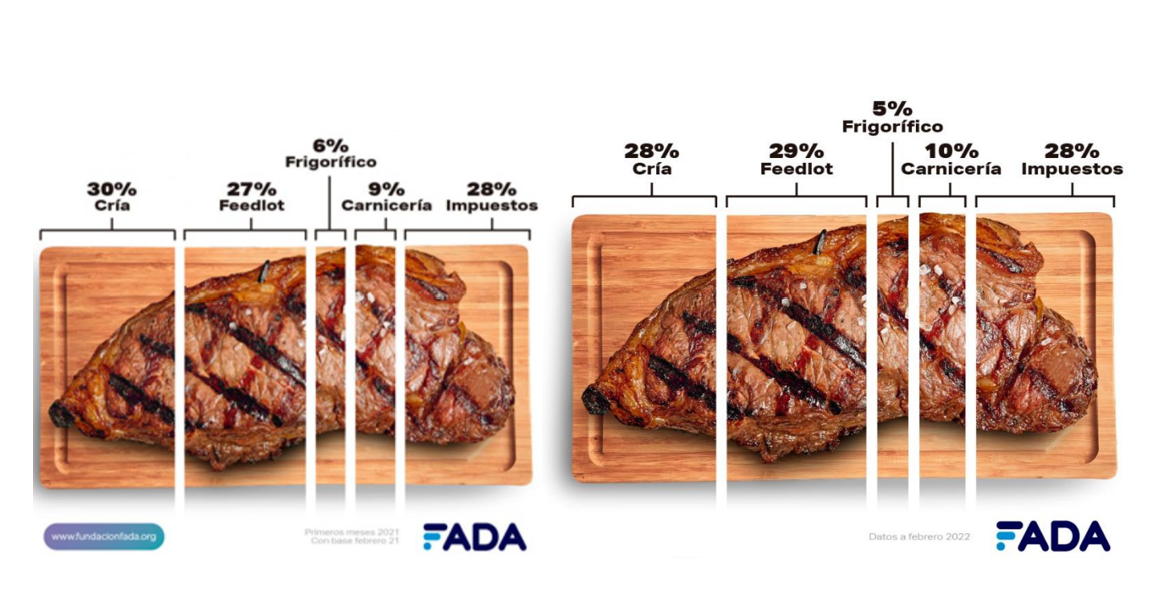

The comparison of the following two images serves as a reference to contextualize it.

The images represent the price components in 2021 and 2022.

If we compare the results of Feb-22 with Feb-21, in the case of breeding, its share dropped 2 p.p. Breeding is in a good situation, maintaining a positive margin given the increase in the price of calves and costs with increases of 63%, 10.7 points above annual inflation. In the case of the feedlot, it increased its share by 2 points, given an improvement in margins compared to previous months. While the price of heifers increased by 65% compared to February 2021, production costs increased, on average, by 56%, mainly driven by marketing, health, feed and cattle purchase costs. However, the increase in the international price of corn and a higher rate of devaluation of the official exchange rate will complicate the systems with grain supplementation and will hurt the feedlot margin. In February, corn accounted for 15% of the price of steer and 11% of the price of meat at the counter, as detailed in the section "Participation of grains in final products".

The meatpacker lowered its share of the final price by 1 p.p., with costs 62% higher than February 2021. In the case of butchers, it increased 1 point, also as a result of the improvement in the margin of the activity, even in a context where it is expected that the price of meat will put a ceiling on the margins of the trade due to the fall in the purchasing power of consumers.

In order to contribute to transparency and reduce misinformation on how the prices of basic foodstuffs in the food basket are composed, FADA prepares a biannual report on the composition of milk, meat and bread prices. The links in the chain are analyzed, from primary production until the final product reaches the consumer. The participation of each of the links, costs and taxes is identified, in order to have a clear picture of why food is worth what it is worth, and to identify where the main problems in each chain may lie.

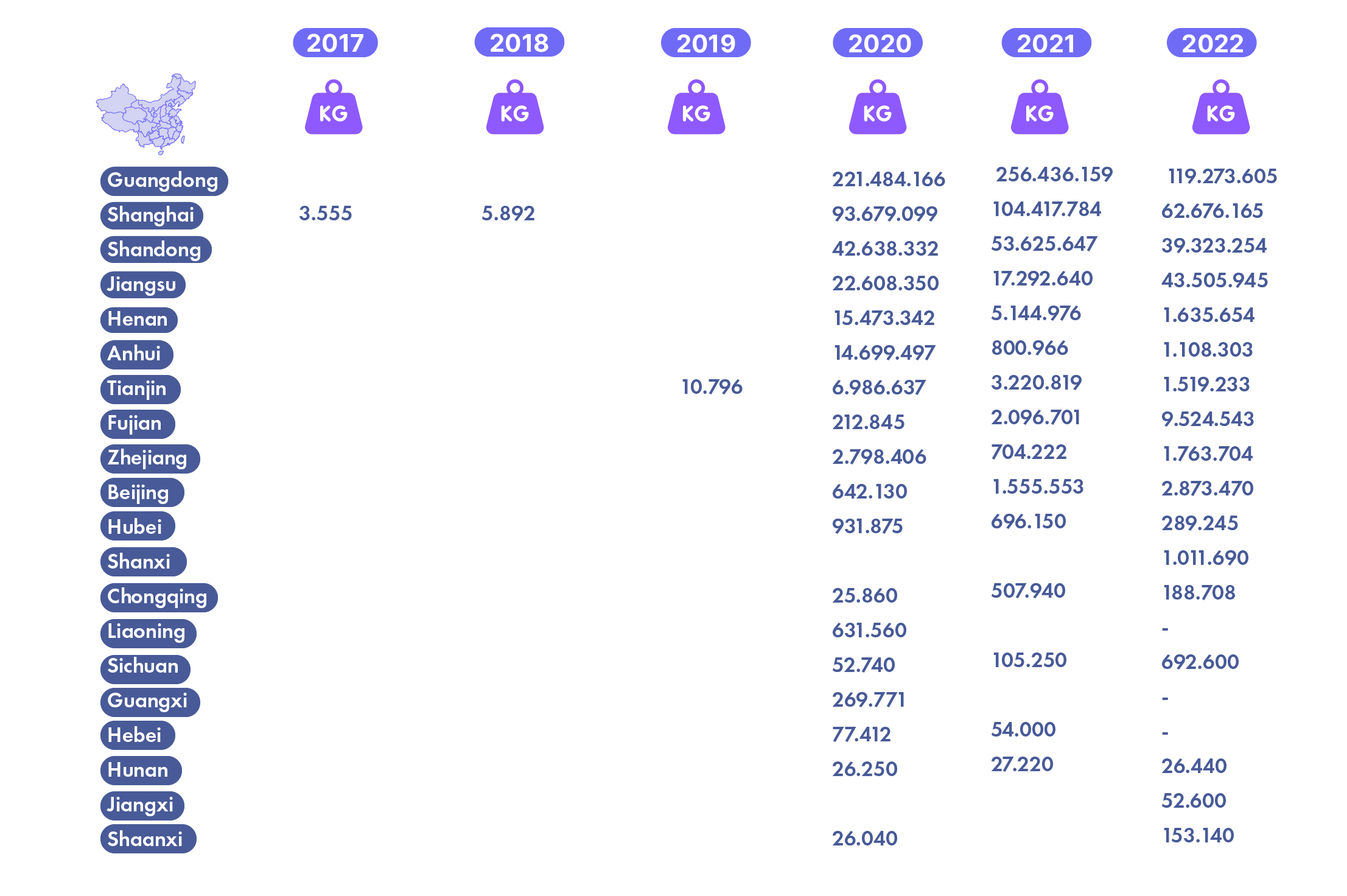

Where has poultry meat been imported to over the years?

The following graph shows the evolution of poultry imports in each province.

The province par excellence that has imported the most over the years is Guangdong. So far in 2022, 119,273,605 kg have already been imported. Close behind is Shanghai with 62,676,165 kg, and in third position is Shandong with 39,323,254 kg.

Poultry meat did not begin to have a fairly significant presence in China until 2020. That year closed with 423,264,312 kg of imported poultry meat.

In the latest report on meat production and trade forecasts made by FAO and OECD, it is estimated that there will be 16% more production by 2031, and in that year, 47% of the total meat exported will be exported.

World meat supply will expand to meet growing demand, reaching 377 million tons by 2031.

Would you like to do market research on the products you export?

Start now by registering in the form below. It won't take more than 2 minutes!

¡Mantente al tanto! Subscríbete a nuestro blog

Mantente al día de todo lo que ocurre en el mercado chino y optimiza tu estrategia.